best online pharmacy to buy isotretinoin Bank Scam #1: Save Money Welcome back to Rich Man Poor Bank. It is finally time to expose the most common scams the biggest banks use to lock up your money–while paying you nothing–while they invest your savings for personal profit. Over the next 10 weeks I will be posting many of the most common scams I see when working with middle-American families. Let’s start with biggest […]

Your Bank is Hiding the Chocolate

By Lilit Barsegyan Imagine yourself in a kitchen where you are assigned to bake a chocolate cake. You are provided with flour, eggs, baking powder and sugar. Wait, where’s the chocolate? Exactly. It’s kind of like when we are told to get good grades and get accepted to a university to find a good job…you know, live the […]

Who is stealing the American Dream?

Have ever asked, “Who is stealing the American Dream?” It has been quite a while since I last posted anything. I have been busy working on the book, speaking engagements, and simply helping educate Americans about their money. With $10,000,000,000 (that is right, trillion with a “T“) sitting lazy in banks, it is apparent that I really need to finish “Rich Man, Poor Bank.” Americans need […]

Get out of Debt: Supercharge the “debt snowball”

If you have ever looked into strategies for getting out of debt, it is very likely you have heard of the “Debt Snowball.” Author, talk show host and personal finance expert Dave Ramsey is a huge promoter of this strategy. In fact, countless people I have met over the years have used Dave’s advice to become debt-free. Now, perhaps you would […]

Bernie Madoff vs. Big Banks

What is the difference between Bernie Madoff and big banking? Bernie Madoff built a multi-billion dollar Ponzi scheme… Big banking (JP Morgan Chase, Wells Fargo, Citibank, Bank of America, Goldman Sacks, and others) have built a multi-trillion dollar Ponzi scheme. Bernie convinced new customers into giving them their money for 48 years before they discovered he was running a Ponzi scheme… Big banking has been convincing […]

Ellen Degeneres helps Bank of America

Did Ellen Degeneres Help Bank of America? I just finished reading an article about how customers want to dump their bank, but many found it too “difficult” to leave. Would a big bank actually charge thier already unhappy customers to leave..? Then I was surprised to find that Ellen DeGeneres is actually “helping” Bank of America create new commercials that really add some truth to banking. Enjoy!

Cast your vote: “Everyday is Bank Transfer Day”

Bank Transfer Day was November 5th 2011. And yesterday alone, 1,000’s of Americans left big banking. Today, 1,000’s more will leave. And tomorrow 1,000’s more Americans will leave big banking…many of them for good. Both Conservatives and Liberals are leaving too. It is good to see that this is one issue we can all agree upon. Even Sandy Weill, former Chairman (and creator) of Citigroup is abandoning big banking. Weill commented, “There is such a feeling among people, […]

Victoria Grant, age 12, exposes the banks

Victoria Grant Exposes the Banks Gasoline was $0.99 cents a gallon in 1998. I remember this because I was broke. I needed money for gas and only had $1.00 in my wallet. That gallon of gasoline actually took me where I wanted to go. Those were the good ol’ days. Just 12 short years later, gasoline is hovering around $4 a gallon […]

Are Credit Unions FDIC Insured?

For anyone who works as a financial professional, it is just a matter of time until they must answer the question, “Are credit unions FDIC Insured?” And yes, I get this question quite often when I am referring folks to their local credit union. Fact is, credit unions have better insurance than the FDIC. To understand how […]

Want to get out of debt? Dave and Selina wanted to be less than “average”

Want to get out of debt? If you ever wondered, How do I get out of debt?, you’re not alone. In fact, you are considered an average household if you have total balances of $16,000 on credit cards alone. For anyone above $16,000–just being “average” could be a big step in the right direction. According to www.creditcards.com, the national average interest rate for credit cards is just under 15%, and a “low” interest card would be 10.4%. Those with “bad […]

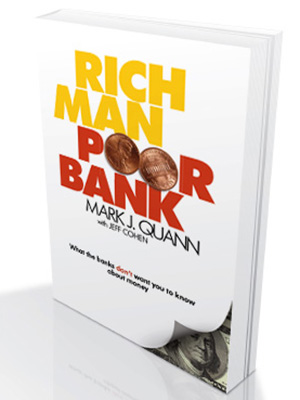

buy prednisolone 5mg for dogs in uk Mark Quann is an entrepreneur with a belief in the liberating power of financial education and a campaign to slash the toxic influence of big banks and credit companies. Read More

buy prednisolone 5mg for dogs in uk Mark Quann is an entrepreneur with a belief in the liberating power of financial education and a campaign to slash the toxic influence of big banks and credit companies. Read More

Mark's new book is available now.

Mark's new book is available now.